Deferred Income Double Entry

As a liability the recorded deferred gains are listed on the right side of the balance sheet equation in liabilities. The balance on the deferred tax liability account is 150 representing the future liability of the business to pay tax on the income for the period.

Deferred Revenue Journal Entry Double Entry Bookkeeping

Prepare the journal entries in the year ended 31 December 20X2.

. The gift cards account represents the value of gift cards outstanding on which the business has an obligation to supply goods at a future date. The account is included in the balance sheet as a current liability under the heading of deferred revenue. Instead we should set up a deferred credit account.

This is when we receive payment by a customer for something but havent actually earned the income so we havent delivered the goods yet. The next step is to record the amount paid by the customer as a journal entry. Deferred income is the exact opposite to accrued income.

This represents a good or service that the business still owes to the customer and if the business fails to hold its end of the bargain the customer may cancel the transaction and request a refund. The amount is credited to the balance sheet gift cards liability account deferred revenue. Accounting for Deferred Income.

In this situation you record the deferred revenue as a long-term liability on the companys balance sheet. Grant of CU 3 000 to cover the expenses for ecological measures made by ABC in 20X0-20X1. Ad E-File your Tax Return Directly to the IRS.

Then at the end of year 1 we can release a quarter of this grant into our statement of profit or loss Dr Deferred Income Cr statement of profit or loss effectively reducing the depreciation expense of 25 down to 20. Dr Accrued income again an asset. Likewise the remaining balance of deferred revenue for the bookkeeping service here will be 2500 3000 500.

Free Federal Double Check. The income tax payable account has a balance of 1850 representing the current tax payable to the tax authorities. The concept is commonly applied to the receipt of money related to service contracts or insurance where the related benefits may not be completed until a number of accounting periods have passed.

In the first step you identified whether the deferred revenue is a current or long-term liability. Quickly Prepare and File Your 2021 Tax Return. Record the amount paid by the customer.

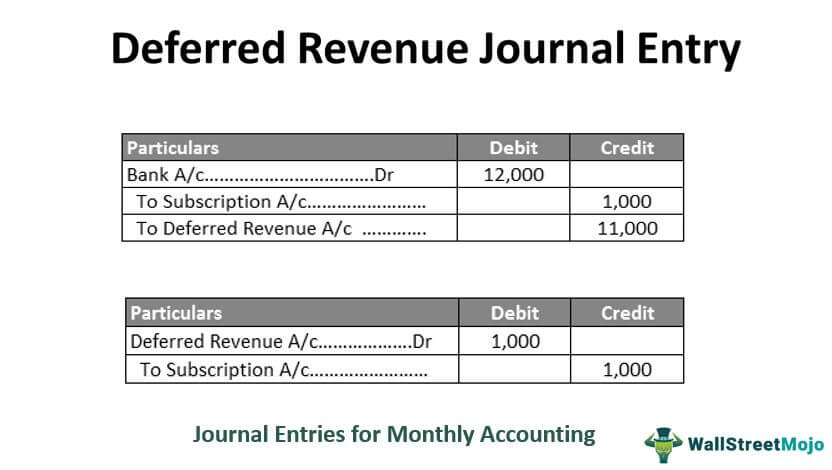

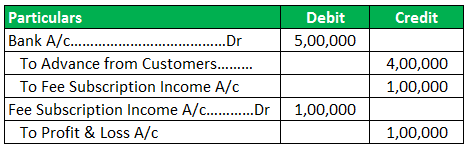

The effect of accounting for the deferred tax liability is to apply the matching principle to the financial. First we have to calculate the income tax expense. Deferred revenue example accounting double entry To create a deferred revenue balance once an invoice has been raised the accounting entry is Cr Deferred Revenue Dr Trade Debtors.

From Simple to Advanced Income Taxes. Income tax expense accounting profit tax rate 50000 20 10000. ABC assumes to spend CU 3 000 in 20X2-20X5 and CU 2 000 in 20X6 CU 14 000 in total.

The double entry for this is. Think of this as an uninvoiced receivable. You will record deferred revenue on your business balance sheet as a liability not an asset.

In this journal entry the company recognizes 500 of revenue for the bookkeeping service the company has performed in October 2020. In most cases the prepayment terms for deferred revenue last for 12. Second we have to calculate the income tax payable.

Grant of CU 10 000 to cover the expenses for ecological measures during 20X2 20X5. But prepayments are liabilities because it is not yet earned and you still owe something to a customer. Deferred income is an advance payment from a customer for goods or services that have not yet been delivered.

Deferred revenue is listed as a liability on a companys balance sheet. If we imagine that this deferred revenue relates to an annual subscription the revenue would be recognised evenly across that year. Receiving a payment is normally considered an asset.

What is the double entry for accrued income. The deferred revenue turns into earned revenue which is an asset only after the customer. So our double entry becomes Dr Cash 20 Cr Deferred Income 20.

Please prepare a journal entry for the deferred tax liability. It would occur in a situation where a customer is paying in advance for goods that we are going to deliver in the future. ABC has to record income tax expenses of 10000 on the income statement.

First Intuition Accrued And Deferred Income Youtube

Accrued Revenue Accounting Double Entry Bookkeeping

No comments for "Deferred Income Double Entry"

Post a Comment